Case Example 1

Carve-out of in-house service unit from stock listed company with

the aim to offer in-house services to external clients.

End-to-end delivery: Outline of business idea,

Quantification, Funding and Dialogue

with vendor, investors & banks.

In-house service unit

In-house service unit

Carve-out of in-house service unit from stock listed company with

the aim to offer in-house services to external clients.

End-to-end delivery: Outline of business idea,

Quantification, Funding and Dialogue

with vendor, investors & banks.

Case Example 1

Carve-out of in-house service unit from stock listed com-

pany with the aim to offer in-house services to external

clients. End-to-end delivery: Outline of business idea,

Quantification, Funding and Dialogue

with vendor, investors & banks.

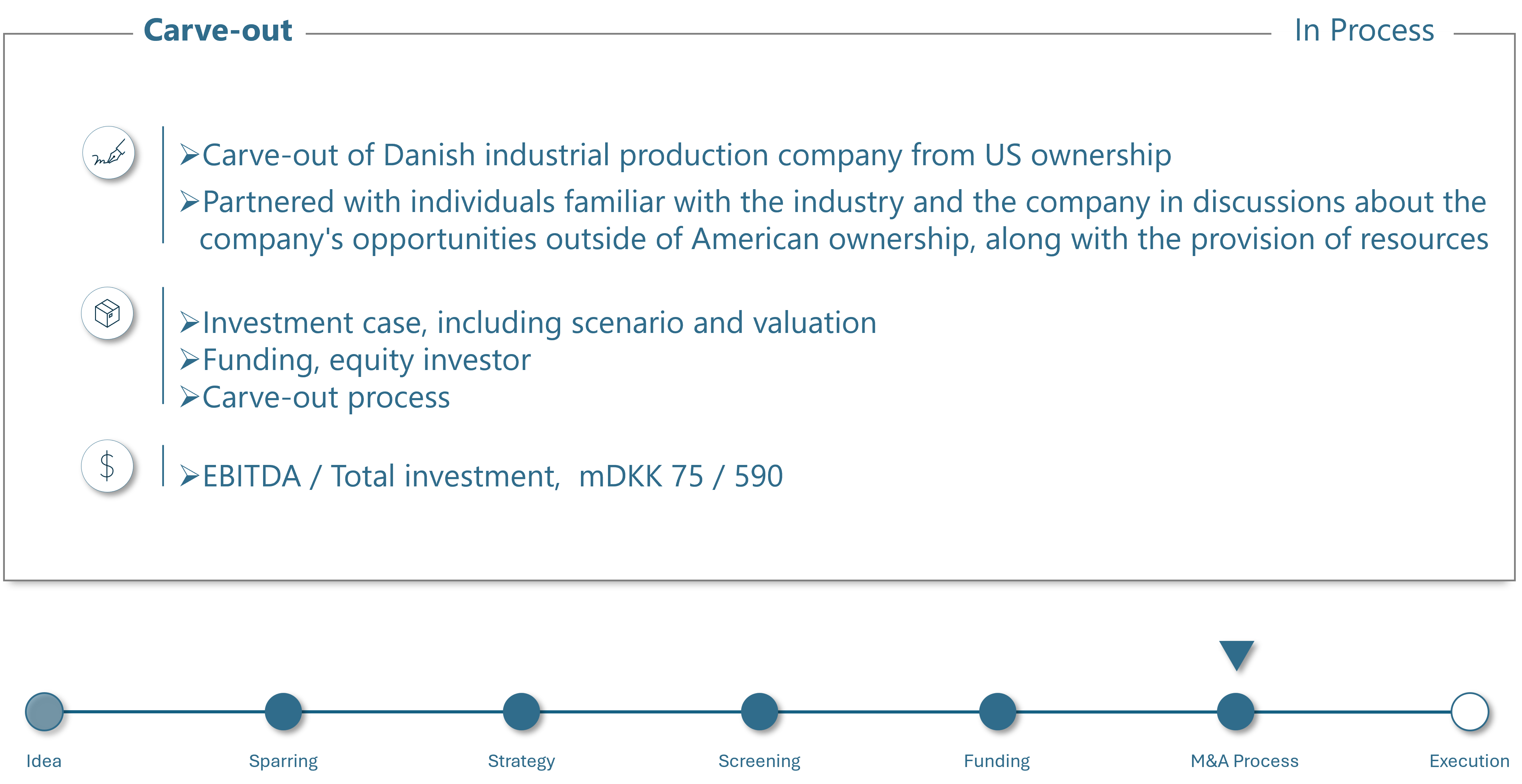

Case Example 2

Carve-out of a traditional industrial production company from its US owners.

The business case incorporates amongst other elements investment in

automation, innovation, and a refocused international sales

strategy. Audacious transformed a loose idea into

an investment case by partnering with multiple

individuals with insight into the industry and

prior consulting and investment

experience.

Case Example 2

Carve-out of a traditional industrial production company

from its US owners. The business case incorporates

amongst other elements investment in automation,

innovation, and a refocused international sales

strategy. Audacious transformed a loose idea

into an investment case by partnering with

multiple individuals with insight into the

industry and prior consulting and

investment experience.

Case Example 3

Identified Roll-up opportunity of an industry facing pivotal changes in its business

foundation. The business case combines: a) Roll-up Strategy, ie acquisition of

leading entities, followed by continuous acquisitions, and b) the acquisition

of a digital business leader in an adjacent business segment, aiming at

accelerated digitalization. Originated the business idea, conducted

quantification, secured funding and engaged in M&A Process.

Case Example 3

Identified Roll-up opportunity of an industry facing pivotal

changes in its business foundation. The business case

combines: a) Roll-up Strategy, ie acquisition of lead-

ing entities, followed by continuous acquisitions,

and b) the acquisition of digital business leaders

in adjacent business segments, aiming at acc-

elerated digitalization. Created the business

idea, conducted quantification, secured

funding and engaged in M&A Process.